WHAT IS TAXABLE INCOME?

What is Taxable Income?

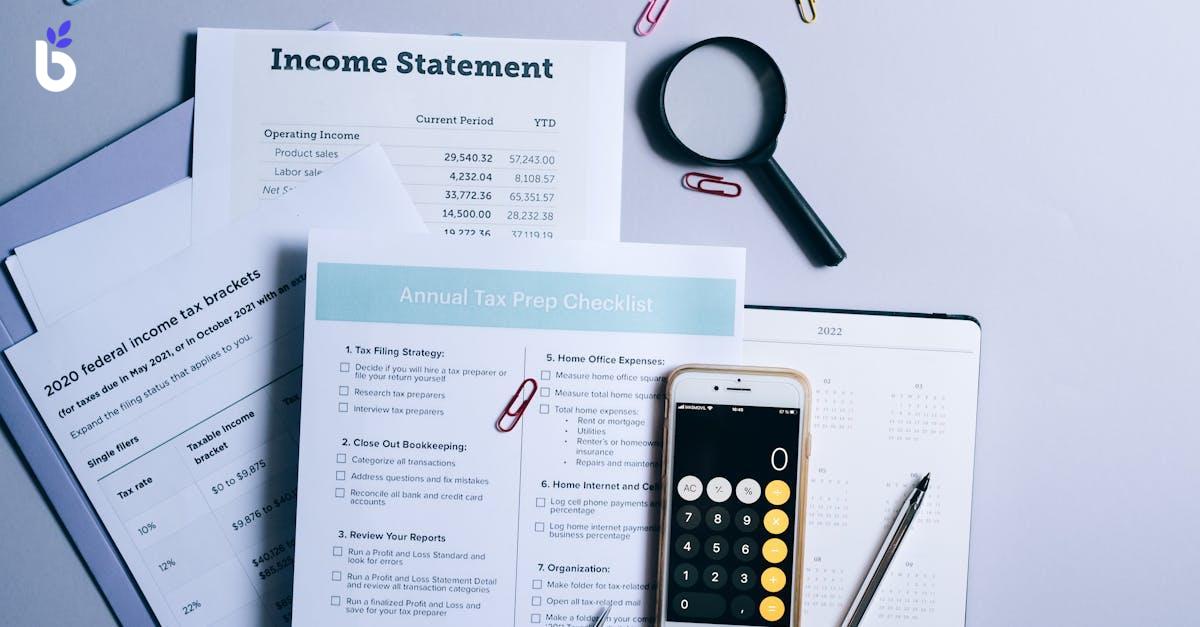

Taxable Income represents the portion of an individual's total income that is liable to be taxed by the government. This critical financial concept includes various sources of earnings, such as salaries, wages, business profits, and investment returns, after accounting for allowable deductions and exemptions. Understanding taxable income is essential for individuals and businesses alike since it determines the tax obligations owed.

In simpler terms, taxable income can be defined as adjusted gross income (AGI) less allowable itemized or standard deductions. It incorporates earnings from salaries, bonuses, tips, as well as unearned income like investments.

Understanding Taxable Income

Grasping the concept of taxable income requires an awareness of the various types of income categorized as taxable, as well as the deductions allowed by the tax code. Each of these aspects affects the final amount that is considered taxable income.

Key Components of Taxable Income

- Types of Income: Taxable income includes wages, investment income, rental income, and other earnings.

- Deductions: Claimable deductions can significantly lower taxable income and may include mortgage interest, student loan interest, and contributions to retirement accounts.

- Exemptions and Allowances: Familiarity with exemptions and allowances also plays a vital role in calculating your taxable income.

"Knowing your taxable income is crucial for effective financial planning and ensuring compliance with tax regulations."

FAQs

What Does Taxable Income Mean?

Taxable income refers to the amount of an individual’s total income that is subject to tax after subtracting any deductions and exemptions.

How to Calculate Taxable Income

To determine taxable income, sum all sources of income for a specific period and then deduct eligible expenses and allowances. This formula positions you to accurately report your taxable income on tax returns.

How Do I Lower My Taxable Income?

Lowering your taxable income can be achieved by taking full advantage of tax-saving investment options, claiming available deductions, and maximizing allowances based on the tax laws. It's often beneficial to consult with a tax advisor for tailored guidance.

Also See: TDS Return | Types of Allowances

Conclusion

Understanding taxable income is fundamental for individuals seeking to navigate their tax responsibilities effectively. By familiarizing yourself with what constitutes taxable income and how to manage deductions and exemptions, you can ensure an optimized tax filing process. This knowledge not only aids in compliance with tax regulations but also empowers you with financial decision-making capabilities.

Take control of your business today

Explore BizCRM App and start your journey towards business success.